Stop Foreclosure in Sacramento: Your Complete Guide (2026)

Stop Foreclosure in Sacramento: Your Complete Guide (2026)

Facing foreclosure is one of the most stressful experiences a homeowner can go through. But here is the truth: you have more options than you think, and taking action now can dramatically change your outcome.

At Community Renaissance, we help Sacramento homeowners facing foreclosure every month. We understand the urgency, the fear, and the desire to protect your credit and walk away with dignity. This guide will help you understand your options and take action.

Understanding California Foreclosure

Non-Judicial Foreclosure

California primarily uses non-judicial foreclosure, meaning:

- No court involvement required

- Faster process than judicial states

- Governed by Civil Code Sections 2924-2924k

- Strict timeline and notice requirements

The Foreclosure Timeline

Days 1-30: First Missed Payment

- Grace period (usually 15 days)

- Late fee assessed

- Lender begins outreach

Days 31-90: Default Period

- Multiple missed payments

- Lender continues contact attempts

- You should be exploring options NOW

Day 90+: Notice of Default (NOD)

- Formal start of foreclosure process

- Filed with county recorder

- 90-day waiting period begins

- You are in PRE-FORECLOSURE

Day 180+: Notice of Trustee Sale (NOTS)

- Sets auction date

- Minimum 21 days before sale

- Published in newspaper

- Posted on property

Auction Day:

- Trustee sale held

- Property sold to highest bidder

- You must vacate

Total Minimum Timeline: Approximately 120 days from NOD to sale

Your Rights During Foreclosure

California law provides protections:

- Right to reinstate: Catch up on payments before sale

- Right to payoff: Pay entire loan balance before sale

- Right to notice: Required notifications at each step

- Right to request meeting: Lender must offer to meet

- Right to apply for modification: Lender must review before foreclosing

Strategies to Stop Foreclosure

Strategy 1: Loan Modification

What It Is: Lender changes your loan terms to make payments affordable

Possible Changes:

- Lower interest rate

- Extended loan term

- Principal reduction (rare)

- Deferred payments added to end

How to Apply:

- Contact lender's loss mitigation department

- Submit complete application with financials

- Await review (30-90 days)

- Negotiate terms if approved

Success Rate: Varies widely; best with documented hardship and ability to pay modified amount

Strategy 2: Forbearance Agreement

What It Is: Temporary pause or reduction in payments

How It Works:

- Payments reduced or paused for set period

- Missed amounts must be repaid later

- Does not reduce total owed

Best For: Temporary hardship (job loss, medical issue) where you expect recovery

Strategy 3: Reinstatement

What It Is: Paying all past-due amounts plus fees to become current

What You Need:

- All missed payments

- Late fees

- Legal fees

- Any other charges

When It Works: You have access to funds (retirement, family, etc.) and can afford ongoing payments

Strategy 4: Sell the Property

If You Have Equity:

- Sell at market value

- Pay off mortgage

- Keep remaining proceeds

- Protect your credit

If You Are Underwater:

- Short sale (lender accepts less than owed)

- Requires lender approval

- Better for credit than foreclosure

Strategy 5: Short Sale

What It Is: Selling for less than owed, lender forgives difference

The Process:

- List property with short sale experience

- Receive offer

- Submit to lender with hardship documentation

- Lender reviews (60-120 days)

- If approved, close sale

Pros:

- Avoids foreclosure on credit

- Less credit damage

- May receive relocation assistance

Cons:

- Long timeline for approval

- May have tax implications

- Buyer may walk during wait

Strategy 6: Deed in Lieu of Foreclosure

What It Is: Voluntarily transfer property to lender

Advantages:

- Avoids foreclosure on record

- Faster resolution

- May include relocation assistance

When It Works:

- No significant equity

- Cannot sell at any price

- Lender agrees to accept deed

Strategy 7: Bankruptcy

How It Helps:

- Automatic stay halts foreclosure immediately

- Chapter 13 allows catching up over 3-5 years

- Can discharge other debts

Considerations:

- Serious credit impact

- Legal costs

- Does not eliminate mortgage

Selling Before Foreclosure

Why Selling Works

If you have equity, selling is often the best option:

- Stop foreclosure and protect credit

- Walk away with cash

- Avoid eviction stress

- Control your timeline

The Fast Sale Process

Day 1: Contact Community Renaissance

- Tell us your situation

- We review your property

Days 1-2: Property Evaluation

- Quick walkthrough

- Market value assessment

Within 24 Hours: Cash Offer

- Fair, no-obligation offer

- Based on market value and condition

Days 2-5: Accept and Sign

- Review with attorney if desired

- Sign purchase agreement

Days 7-14: Close

- We coordinate with your lender

- Pay off mortgage

- You receive proceeds

Timing Is Critical

| Time Before Auction | Options Available |

|---|---|

| 60+ days | All options (modification, sale, refinance) |

| 30-60 days | Sale (cash buyer), short sale, bankruptcy |

| 14-30 days | Cash sale, bankruptcy, reinstatement |

| Under 14 days | Cash sale (expedited), reinstatement, bankruptcy |

| Day of auction | Reinstatement (if allowed), bankruptcy filing |

Do not wait. Contact us today if you are facing foreclosure.

Sacramento-Specific Information

Foreclosure Filing Locations

Sacramento County Recorder's Office: 600 8th Street, Sacramento, CA 95814

Notice of Default and Notice of Trustee Sale are public records filed here.

Trustee Sale Locations

Auctions typically occur at:

- Sacramento County Courthouse steps

- Designated auction company locations

Local Resources

Sacramento County Housing Counseling:

- HUD-approved agencies provide free foreclosure counseling

- www.hud.gov/findacounselor

Legal Aid:

- Legal Services of Northern California: (916) 551-2150

Avoiding Foreclosure Scams

When you are desperate, scammers appear. Watch out for:

Red Flags:

- Guarantees to stop foreclosure

- Requests for upfront fees

- Pressure to sign over your deed

- Instructions to stop talking to your lender

Protect Yourself:

- Never pay large upfront fees

- Never sign documents you do not understand

- Never deed property as a "rescue"

- Work with HUD-approved counselors

Community Renaissance is legitimate. We never ask for upfront fees, never ask you to sign over your deed before closing, and always provide transparent written offers.

Take Action Today

The sooner you act, the more options you have.

Ready for a cash offer? Get your free offer today

Need to talk? Call us now. We answer foreclosure calls 7 days a week.

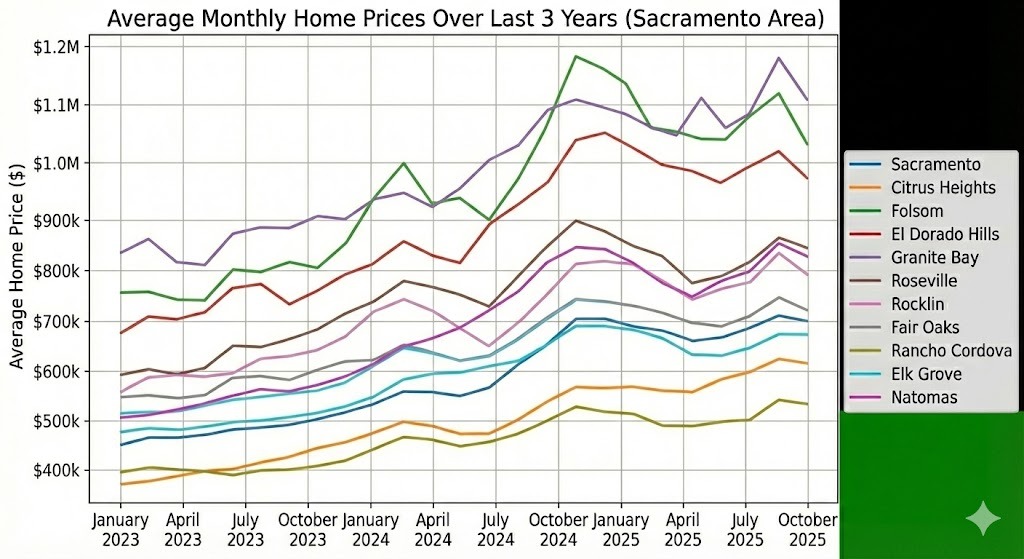

Serving: Sacramento, Elk Grove, Rancho Cordova, Citrus Heights, Stockton, Roseville, Folsom, Carmichael, Fair Oaks, and all surrounding areas.

Get Help in Your Area

Ready to Sell Your Home?

Get a free, no-obligation cash offer for your Sacramento area home. We can close in as little as 7 days.

Get My Cash OfferRelated Articles

Cash vs. Listing: The Real Math for Sacramento Sellers

We run the numbers on a real Sacramento home sale. See the breakdown of a $500k listing vs. a $460k cash offer. The winner might surprise you.

The Ultimate Guide to Selling Your Home "As-Is" in Sacramento

Skip the repairs, cleaning, and open houses. Learn how selling as-is works, who it's for, and how to get the fair value for your property.